Sales Tax Reporting Instructions

District of Columbia and Virginia General Sales Tax Reporting Requirements

- ALL GW Departments that are performing taxable sales transactions report D.C. and VA Sales Tax to UAS (University Accounting Services)

- Deadline - Report Sales Taxes before the 10th of the following month

- Form due even if there are no taxable sales during the reporting month

- Send by email

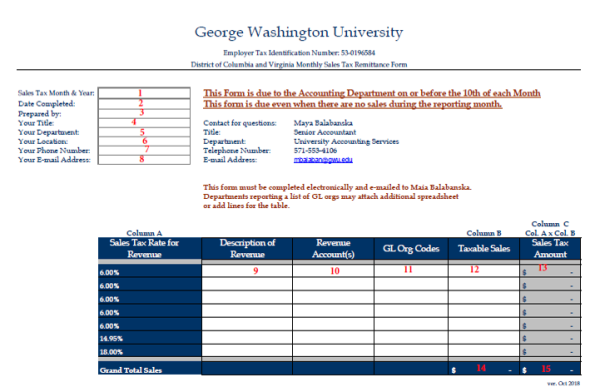

Remittance Form

Steps for Form Field Completion

1 - Month and year for which the sales tax is being reported

2 - Date the form is completed

Items 3-8 are relatively constant:

3 - Preparer

4 - Title

5 - Department

6 - Location

7 - Telephone number

8 - Email address

9 - Description of revenue (e.g. what has been sold - basketball tickets, summer housing, candy, printing etc.)

10 - Revenue account number(s) - account numbers where all taxable revenue has been booked

11 - GL org code. Separate sales by org codes. If there is a long list of orgs (e.g., Summer Housing), a separate spreadsheet may be attached.

12 - Taxable sales- total taxable sales for the month. This amount should be equal to the balance in the revenue accounts which records only the taxable revenue and is verified by the department

13 - Sales Tax - sales tax is automatically calculated depending on the category (different %). This amount should be equal to the monthly balance in the Sales Tax account (21281) for the month and is verified by UAS.

14 - Total Taxable sales - auto calculated

15 - Total Sales Tax - auto calculated

Source Documents

EAS Report 324B (csv format) - to verify total taxable sales

EAS Report 329 (csv format) - to verify total tax

Excel spreadsheets

Timing

Taxes booked in the following month can be reported the next month.